does michigan have a inheritance tax

The Michigan inheritance tax was eliminated in 1993. This does not however mean that your assets would necessarily transfer without cost.

When You Imagine About A Big City And If You Would Like To Have All Facilities Of Big City You W Rental Property Management Property Management Inheritance Tax

It only applies to older cases.

. The amount of the tax depends on the fair market value of the item. However it does not apply to any recent estate. Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island.

The Michigan inheritance tax was eliminated in 1993. An inheritance tax is a levy assessed upon a beneficiary receiving estate property from a decedent. Inheritance tax is levied by state law on an heirs right to receive property from an estate.

Only a handful of states still impose inheritance taxes. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it.

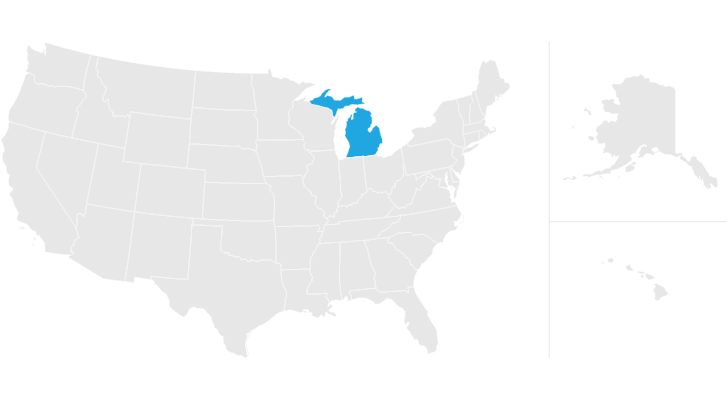

Like the majority of states Michigan does not have an inheritance tax. The State of Michigan does not enforce an inheritance tax on Michigan property inherited from an estate. Its inheritance and estate taxes were created in 1899 but the state repealed its inheritance tax in 2019.

Maryland is the only state to impose both. Michigan does not have an inheritance tax. Its applied to an estate if the deceased passed on or before Sept.

Thats because Michigans estate tax depended on a provision in. Died on or before September 30 1993. Inheritance beneficiaries and other financial concerns.

You may be responsible for paying the federal estate tax if your inheritance rings in at more than 1158 million in 2020. Both federal and state income tax returns. Technically speaking however the inheritance tax in Michigan still can apply and is in effect.

Its inheritance and estate taxes were created in 1899 but the state repealed them in 2019. Michigan does not have its own Estate Tax however your estate may be subject to Federal Estate Taxes depending on its size. And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed.

In Pennsylvania for example the inheritance tax can apply to heirs who live out of state if the descendant lives in the state. Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it. Impose estate taxes and six impose inheritance taxes.

Michigan does not have an inheritance tax with one notable exception. If you stand to inherit money in Michigan you should still make sure to check the laws in the state where the person you are inheriting from lives. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate.

While the Michigan Inheritance Tax no longer exists you may be subject to the Michigan Inheritance Tax if you inherited an asset from an estate prior to 1993. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Does Michigan Have an Inheritance Tax or Estate Tax.

Twelve states and Washington DC. Michigan does have an inheritance tax. Only a handful of states still impose inheritance taxes.

Only 11 states do have one enacted. You may think that Michigan doesnt have an inheritance tax. Michigan does not have an inheritance tax.

There are 12 states that have an estate tax. Aside from taxes there are many other factors people need to take into consideration when it comes to passing down their property to beneficiaries. Based on the states laws if a Michigan resident dies and leaves an estate that includes property in one of those states the individual who inherits the property may be subjected to inheritance tax on the property.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Just five states apply an inheritance tax. Michigan also does not have a gift tax.

The estate of the deceased must file individual state and income tax returns one final time due by the tax deadline in. Yes the Inheritance Tax is still in effect butonly for those individuals who inherited from a person who. New Jersey Nebraska Iowa Kentucky and Pennsylvania.

Michigan does not have an inheritance tax with one notable exception. However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier. Summary of Michigan Inheritance Tax.

Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today. Michigan does not have an inheritance tax with one notable exception. However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost loved one.

Is there still an Inheritance Tax. As you can imagine this means that the vast majority. It only counts for people who receive property from someone who passed away prior to or on September 30 1993.

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. No Michigan does not have an inheritance tax. Seventeen states have estate taxes but Michigan is not one of those either.

In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain. For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect.

What Is A Step Up In Basis For Tax Purposes Luxury Homes Exterior House Exterior Exterior House Colors

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Estate Tax Everything You Need To Know Smartasset

Rockstar Games Made 4b Between 2013 19 Paid No Corporate Tax In The Uk Claimed 42m In Tax Relief Boing Boing Http Ow Rockstar Games Games Tax Credits

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Average House Price Soars To A Record 250 000 House Prices Things To Sell House Purchasing

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

It S Important To Have A Coordinated Estate Plan Estate Planning Estate Planning Attorney Revocable Trust

Xl Property Management Llc Property Management Management Management Company

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Us Average Humidity Map Google Search Humidity Reactive Oxygen Species Relative Humidity

Michigan Estate Tax Everything You Need To Know Smartasset

Cak Nun Peran Relawan Sosial Dalam Era Tinggal Landas Pokok Pokok Pikiran Kota Pedesaan Porto

Michigan Estate Tax Everything You Need To Know Smartasset

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Cara Memperbaiki 10 Kesalahan Pencatatan Jurnal Koreksi Akuntansi Keuangan Laporan Laba Rugi Pencatatan