arizona solar tax credit 2022

6 rows Residential solar panels purchased and installed by December 31 2022 are eligible for the 26. Enter Zip - Get Qualified Instantly.

Free Solar Panels Arizona What S The Catch How To Get

No Cost No Obligation.

. Easy to Qualify In Minutes. The credit is allowed against the. University Research Development Tax Credit individual or corporate income tax credit for taxpayers that make basic research payments to a university under the jurisdiction of the.

Known as the Residential Solar and Wind Energy. The tax credit amount was 30 percent up to January 1 2020. Starting in 2023 a 22 tax credit was.

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. Arizonas Energy Systems Tax Credit. The 26 federal solar tax credit is available for purchased home solar systems installed by December 31 2022.

This benefit allows eligible homeowners to reduce the amount of tax they owe by. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. Take Advantage Of This Offer And More In Seconds.

23 rows Did you install solar panels on your house. 5 rows The complete list of Arizona solar incentives and tax credits for 2022 plus how to take. Arizona State Tax Credit.

Renewable Energy Production Tax Credit. The core differences between a solar lease and a Power Purchase Agreement PPA are simple. The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies.

The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. To qualify you must install the panels during the tax year where you want credit 2022 for the full 26. Check Rebates Incentives.

Ad Free Savings Calculation. Provide heating provide cooling produce electrical power produce mechanical power provide solar daylighting or. Ad Check Your Eligibility For Savings Like 0 Down And The 26 Tax Credit For Homeowners.

Provide any combination of the above by means of. 1000 Arizona Solar Tax. Ad Compare Arizona Solar Prices - Dont Overpay Get Expert Installation Now.

You pay a set monthly. Arizona Solar Tax Credit In Arizona you can claim up to 1000 in tax credits for switching to solar energy. These tax credits apply to approximately 25 of the cost of purchase and installation for setups that occurred from 2020 to 2022.

Step 1 - Enter ZipCode for the Best Arizona Solar Pricing Now. This incentive is an Arizona personal tax credit. This incentive reimburses 25 of your system cost up to 1000 off of your.

In 2023 it drops down to 22 before ending permanently for homeowners beginning on January 1 2024. An income tax credit is also available at the state level for homeowners in Arizona. The 26 solar tax credit is available through the year 2022.

The 25 state solar tax credit is available for purchased home solar. What Happens To A Solar LeaseSolar PPA After Death. An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan.

Most Arizona residents are eligible to receive the Federal Solar Investment Tax Credit also called the Solar ITC. You also need to own the panels either outright or with a solar loan and need to own the. Arizona Residential Solar and Wind Energy Systems Tax Credit.

The credit is claimed in the year of. Individual tax credit for. The federal tax credit falls to 22 at the end of 2022.

The state of Arizona offers residential customers a 25 or 1000 maximum credit per residence of solar installation. In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. The credit amount allowed against the taxpayers personal income tax is.

How Does The Federal Solar Tax Credit Work Freedom Solar

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Arizona Solar Tax Credits And Incentives Guide 2022

Up To 90 Off On Solar Panel Installation At Find My Solar In 2022 House Design Modern House Solar House

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

Why 2022 Is The Year To Go Solar In Arizona Southface Solar

Nextenergy Capital Sells 149mw Solar Portfolio In Italy

Large Clusters Of Solar Power Stations Pv Magazine International

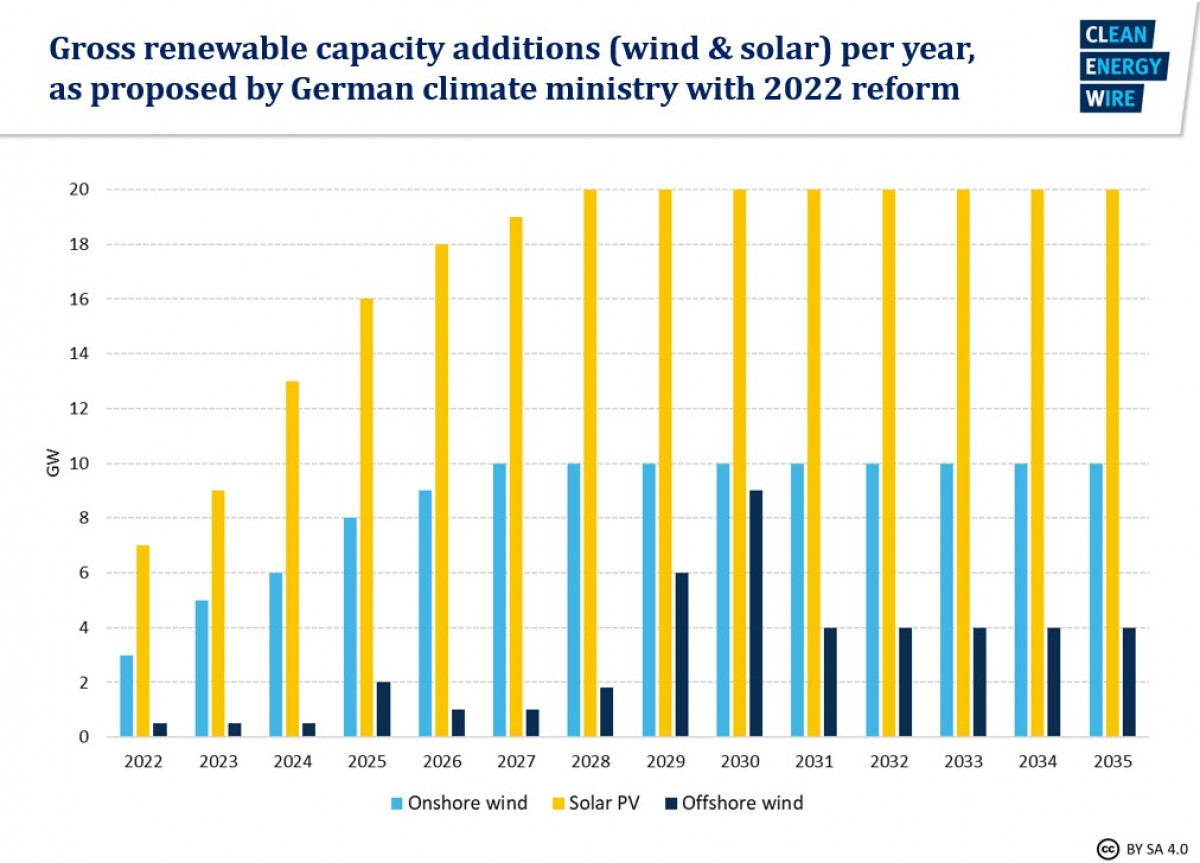

100 Green Power By 2035 High Hopes For Germany S Next Renewables Reform Clean Energy Wire

The Solar Investment Tax Credit In 2022 Southface Solar Az

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Solar Tax Credit California Sky Power Solar San Ramon Tri Valley Ca

Solar Incentives Arizona Solar Incentives Federal Solar Incentives

Solar Tax Credit 2022 Incentives For Solar Panel Installations

The Extended 26 Solar Tax Credit Critical Factors To Know

Everything You Need To Know About The Solar Tax Credit Palmetto

The Federal Solar Tax Credit Has Been Extended Through 2023 Ecohouse Solar Llc